Executive Summary

The proprietary trading (prop trading) industry has undergone significant transformation in recent years, with funded prop firms emerging as a dominant force in retail trading. This comprehensive guide explores everything you need to know about prop firms, from traditional institutions to modern funded trader programs.

Global prop trading volumes exceeded $7.2 trillion in daily transactions in 2023, with funded prop firms accounting for an increasingly significant portion of this activity. As technology democratizes access to institutional-grade trading infrastructure, the industry continues to evolve, creating new opportunities for skilled traders worldwide.

Key Industry Statistics:

- Over 200 active funded prop firms globally

- Average funded trader success rate: 12-15%

- Industry standard profit split: 70-90% to successful traders

- Typical initial funding: $50,000 to $200,000

- Annual industry growth rate: 25-30%

Understanding Prop Trading

What is Prop Trading?

Proprietary trading, or prop trading, refers to a trading model where firms trade financial instruments using their own capital rather than client funds. Modern prop firms have evolved this concept by creating funded trader programs that allow qualified traders to access firm capital while sharing profits.

Traditional prop trading typically involved:

- In-house traders working from office locations

- Substantial initial capital requirements

- Limited scalability due to physical constraints

- Intensive in-person training programs

Today's funded prop firms offer:

- Remote trading opportunities

- Lower barriers to entry

- Scalable online evaluation processes

- Technology-driven operations

- Global accessibility

Business Models in Modern Prop Trading

1. Traditional Prop Firms

- Direct employment model

- Office-based trading

- Comprehensive training programs

- Higher initial capital requirements

- Structured career progression

2. Funded Trader Programs

- Remote evaluation process

- Performance-based funding

- Scalable capital allocation

- Flexible working arrangements

- Technology-driven operations

3. Hybrid Models

- Combined office and remote options

- Educational components

- Multiple asset class access

- Varied funding structures

- Innovation in risk management

Types of Prop Trading Firms

Traditional Prop Firms

Traditional prop firms maintain a more conventional structure, typically requiring:

- Physical presence in major financial centers

- Substantial initial capital commitment

- Extensive training periods

- Direct mentorship

- Team-based trading approaches

Leading traditional firms often provide:

- Comprehensive training programs

- Advanced trading infrastructure

- Direct market access

- Professional development

- Career advancement opportunities

Funded Trader Programs

Modern funded trader programs have revolutionized the industry by offering:

Evaluation Process

- Challenge Phase

- Initial capital simulation

- Risk management rules

- Profit targets

- Trading restrictions

- Verification Phase

- Extended evaluation period

- Consistent performance requirements

- Risk compliance monitoring

- Trading style analysis

- Funded Account

- Live capital allocation

- Profit-sharing structure

- Scaling opportunities

- Ongoing support

Key Requirements for Success

Technical Skills

- Market analysis proficiency

- Platform expertise

- Risk management capability

- Statistical analysis

- Programming knowledge (preferred)

Personal Attributes

- Disciplined approach

- Emotional control

- Analytical mindset

- Continuous learning attitude

- Professional communication

Risk Management and Compliance

Risk Parameters

Typical rules include:

- Maximum daily loss limits

- Overall account drawdown restrictions

- Position size limitations

- Overnight holding requirements

- Restricted trading hours

Compliance Requirements

Traders must adhere to:

- Trading rules and restrictions

- Reporting obligations

- Documentation requirements

- Communication protocols

- Ethics guidelines

Trading Technology and Infrastructure

Essential Trading Tools

Hardware Requirements

- High-performance computers

- Multiple monitors

- Reliable internet connection

- Backup power systems

- Mobile trading capability

Software Solutions

- Professional charting platforms

- Order execution systems

- Risk management tools

- Market data feeds

- Analysis software

Success Factors and Performance Metrics

Key Performance Indicators

Profit Metrics

- Return on capital

- Win rate

- Average winner size

- Profit factor

- Maximum drawdown

Risk Metrics

- Sharpe ratio

- Sortino ratio

- Value at Risk (VaR)

- Risk-adjusted returns

- Maximum drawdown percentage

Compensation and Economics

Profit-Sharing Structures

Typical arrangements include:

- 70-90% profit split for traders

- Scaling plans for consistent performers

- Performance-based capital increases

- Monthly payout schedules

- Bonus opportunities

Economic Considerations

Traders should consider:

- Living expenses during evaluation

- Technology investments

- Data feed costs

- Training expenses

- Tax implications

Future Outlook and Industry Trends

Emerging Trends

The prop trading industry is evolving with:

- AI and machine learning integration

- Automated trading systems

- Cloud-based infrastructure

- Social trading components

- Educational platforms

Future Opportunities

Growth areas include:

- copyright trading

- Algorithmic trading

- High-frequency trading

- Cross-asset strategies

- Global market access

Getting Started Guide

Step-by-Step Process

- Preparation Phase

- Skill assessment

- Education and training

- Platform familiarization

- Strategy development

- Risk management planning

- Evaluation Process

- Firm research and selection

- Challenge account registration

- Trading plan development

- Performance monitoring

- Rule compliance

- Funded Account Management

- Capital preservation focus

- Scaling plan execution

- Performance documentation

- Professional development

- Network building

Comprehensive FAQ Section

Common Questions

Q: What is the minimum capital required to start? A: Most funded programs require no personal capital for trading, but evaluation fees typically range from $200 to $1,000.

Q: How long does the evaluation process take? A: Typically 1-3 months, depending on the program and performance.

Q: What are typical profit-sharing arrangements? A: Most firms offer 70-90% of profits to successful traders.

Q: Can I trade part-time? A: Yes, many programs allow flexible trading hours, though some restrict trading during major news events.

Q: What markets can I trade? A: Options vary by firm but typically include forex, futures, stocks, and cryptocurrencies.

Expert Insights and Best Practices

Success Strategies

- Focus on consistency over high returns

- Maintain strict risk management

- Document all trades and analyses

- Continuously improve skills

- Build professional networks

Common Pitfalls to Avoid

- Overtrading

- Ignoring risk parameters

- Emotional decision-making

- Poor preparation

- Inconsistent strategy application

Conclusion

The funded prop firm industry continues to evolve, offering unprecedented opportunities for skilled traders to access institutional capital. Success requires a combination of technical expertise, disciplined risk management, and professional development commitment.

Next Steps for Aspiring Prop Traders

- Assess your current trading knowledge and skills

- Develop a comprehensive learning plan

- Research and compare prop firm programs

- Create a detailed trading plan

- Begin the evaluation process with a chosen firm

Additional Resources

- Industry associations

- Educational platforms

- Trading communities

- Professional networks

- Market analysis tools

Remember that success in prop trading requires dedication, discipline, and continuous learning. Start with thorough preparation and maintain a professional approach throughout your journey.

This guide is regularly updated to reflect current market conditions and industry developments. Last updated: November 2024

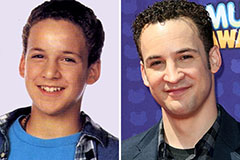

Ben Savage Then & Now!

Ben Savage Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Kelly Le Brock Then & Now!

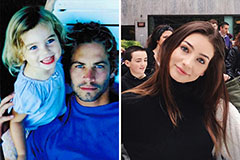

Kelly Le Brock Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!